How Not To Get Tax On Money Received From Insurance Annuity

Key Takeaways

- You will pay taxes on the full withdrawal amount for qualified annuities. You will only pay income taxes on the earnings if it's a non-qualified annuity.

- Income payments from your annuity are evenly divided by the principal amount and its tax exclusions over the expected number of payments.

- Withdrawing money from your annuity before turning 59 ½ years old will result in a 10 percent early withdrawal penalty in most cases.

One of the main tax advantages of annuities is they allow investments to grow tax-free until the funds are withdrawn. This includes dividends, interest and capital gains, all of which may be fully reinvested while they remain in the annuity. This allows your investment to grow without being reduced by tax payments.

But this seemingly simple perk is accompanied by a raft of complicated rules about what funds are taxed, how they are taxed and when they are taxed.

Because of the complexity, it's best to consult with a tax professional when purchasing an annuity and before withdrawing any funds.

Wendy Swanson, Retirement Income Certified Professional with Annuity.org, explains how annuities are taxed.

Are Annuities Taxable?

Annuities are tax deferred. But that doesn't mean they're a way to avoid taxes completely. What this means is taxes are not due until you receive income payments from your annuity. Withdrawals and lump sum distributions from an annuity are taxed as ordinary income. They do not receive the benefit of being taxed as capital gains.

Pro Tip

How taxes are determined depends on many factors centering on how the annuity was set up.

Grow Your Money With an Annuity

Our experts can help you leverage the tax benefits of an annuity.

How Are Annuities Taxed?

When it comes to taxes, the most important piece of information about your annuity is whether it is held in a qualified or non-qualified account.

| Qualified Annuity | Non-Qualified Annuity | |

|---|---|---|

| Funded | Untaxed Money | After-tax funds |

| Payments | Taxable as income | Taxation determined by exclusion ratio |

Qualified Annuity Taxation

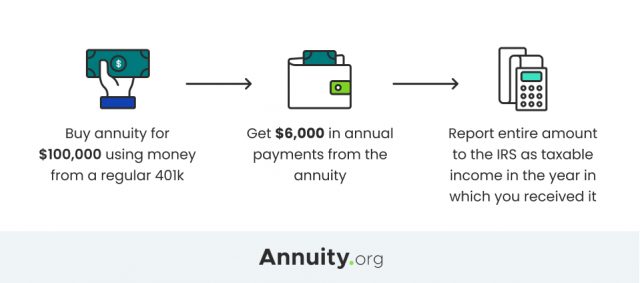

If an annuity is funded with money on which no taxes have been previously paid, then it's considered a qualified annuity. Typically, these annuities are funded with money from 401(k)s or other tax-deferred retirement accounts, such as IRAs.

When you receive payments from a qualified annuity, those payments are fully taxable as income. That's because no taxes have been paid on that money.

But annuities purchased with a Roth IRA or Roth 401(k) are completely tax free if certain requirements are met.

Expand

Qualified Annuity Taxation Example

Non-Qualified Annuity Taxation

If the contract was purchased with after-tax funds — meaning money that has been reported to the IRS as income and taxed accordingly — then the annuity is non-qualified. Non-qualified annuities require tax payments on only the earnings.

The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio. The exclusion ratio is used to determine what percentage of annuity income payments is taxable and how much is not. The idea is to determine the amount of a withdrawal or payment from an annuity is from the already-taxed principal and how much is considered taxable earnings.

The exclusion ratio involves the principal that was used to purchase the annuity, the amount of time the annuity has existed and the interest earnings.

Pro Tip

The exclusion ratio takes into account life expectancy.

If an annuitant lives longer than his or her actuarial life expectancy, any annuity payments received after that age are fully taxable.

That's because the exclusion ratio is calculated to spread principal withdrawals over the annuitant's life expectancy. Once all the principal has been accounted for, any remaining income payments or withdrawals are considered to be from earnings.

Exclusion Ratio Example

- Your life expectancy is 10 years at retirement.

- You have an annuity purchased for $40,000 with after-tax money.

- Annual payments of $4,000 – 10 percent of your original investment – is non-taxable.

- You live longer than 10 years.

- The money you receive beyond that 10-year-life expectation will be taxed as income.

Financial expert Juliette Fairley explains the tax advantages and disadvantages to owning an annuity.

Annuity Withdrawal Taxation

How and when you withdraw funds from your annuity also affects your tax bill.

In general, if you withdraw money from your annuity before you turn 59 ½, you may owe a 10 percent penalty on the taxable portion of the withdrawal.

After that age, taking your withdrawal as a lump sum rather than an income stream will trigger the tax on your earnings. You'll have to pay income taxes that year on the entire taxable portion of the funds.

If money is left in your annuity account, the IRS considers the first and subsequent withdrawals to be interest and subject to taxes.

Regardless of how you withdraw the money, the tax status of the contract, whether qualified or non-qualified, determines how much of the withdrawal will be taxed. If it's a qualified annuity, you will pay taxes on the full withdrawal amount. If it is non-qualified, you will pay income taxes on the earnings only.

Annuity Payout Taxation

According to the General Rule for Pensions and Annuities by the Internal Revenue Service, as a general rule, each monthly annuity income payment from a non-qualified plan is made up of two parts. The tax-free part is considered the return of your net cost for purchasing the annuity. The rest is the taxable balance, or the earnings.

When you receive income payments from your annuity, as opposed to withdrawals, the idea is to evenly divide the principal amount — and its tax exclusions — out over the expected number of payments. The rest of the amount in each payment is considered earnings subject to income taxes.

Get Your Free Guide to Annuities

Learn from the experts and get our 101-level guide, Annuities Explained, delivered to your inbox for free.

Inherited Annuity Taxation

If you are the beneficiary and inherit an annuity, the same tax rules apply. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Principal that was not taxed and earnings will be subject to taxation as income. The amount of previously taxed principal included in each annuity income payment is considered excluded from federal income tax requirements. This is known as the exclusion amount.

Frequently Asked Questions About Annuity Taxation

Do you pay taxes on annuities?

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings. A beneficial reason to buy annuities is that they can grow tax-deferred in the accumulation phase.

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: November 24, 2021

11 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

- Internal Revenue Service. (n.d.). Topic Number 410 – Pensions and Annuities. Retrieved from https://www.irs.gov/taxtopics/tc410

- Sahadi, J. (2018, May 11). Before choosing an annuity, know the tax implications. Retrieved from https://money.cnn.com/2018/05/11/pf/taxes/annuities-taxes/index.html

- White, H. (2018. July 28). Tax Planning for Annuities. Retrieved from http://www.myprimetimenews.com/tax-planning-for-annuities-2/

- Lankford, K. (2017, August 9). Figuring out taxes on variable annuity withdrawals. Retrieved from https://www.chicagotribune.com/business/success/tca-figuring-out-taxes-on-variable-annuity-withdrawals-20170809-story.html

- Connick, W. (2017, September 13). Will My Annuity Payments be Taxed? Retrieved from https://www.fool.com/taxes/2017/09/13/will-my-annuity-payments-be-taxed.aspx

- Investopedia. (n.d.). Exclusion Ratio. Retrieved from https://www.investopedia.com/terms/e/exclusionratio.asp

- ThinkAdvisor. (n.d.). Question About Exclusion Ratio. Retrieved from https://www.thinkadvisor.com/2009/05/26/ask-the-expert-how-to-explain-the-exclusion-ratio/

- Brantley, C. (n.d.) Do I Have to Pay Taxes on an Inherited Annuity of My Deceased Father? Retrieved from https://budgeting.thenest.com/pay-taxes-inherited-annuity-deceased-father-34329.html

- Investopedia. (n.d.). What are the distribution options for an inherited annuity? Retrieved from https://www.investopedia.com/ask/answers/09/inherited-annuity-distribution.asp

- Investopedia. (n.d.). Taxation of Annuities. Retrieved from https://www.investopedia.com/ask/answers/082715/how-are-nonqualified-variable-annuities-taxed.asp

- Internal Revenue Service. (2013, December). General Rule for Pensions and Annuities. Retrieved from https://www.irs.gov/pub/irs-pdf/p939.pdf

How Not To Get Tax On Money Received From Insurance Annuity

Source: https://www.annuity.org/annuities/taxation/

Posted by: vangorderwhout1940.blogspot.com

0 Response to "How Not To Get Tax On Money Received From Insurance Annuity"

Post a Comment